Following the meteoric rise of streaming services within the TV landscape, FreeWheel collaborated with the independent, consumer-focused market research company, Happydemics to explore the latest perspectives of Connected TV (CTV) viewers, their streaming habits, and their attitudes towards advertising-supported video on demand (AVOD).

UK, Italy, France, Germany, Spain and the Netherlands (“EU6”)*. It revealed that EU6 CTV viewers are on average accessing 3.5 streaming platforms, with 91% of these respondents using them to watch all types of video-on-demand (VOD) platforms – including broadcaster-led (BVOD), subscription-based (SVOD) and advertiser-funded (AVOD) – along with live TV.

As the streaming phenomenon continues to build momentum, the survey looked at key accelerators and the opportunities it presents for the European TV ecosystem, as well as uncovering exclusive local insights for the UK, Italy, France, Germany, Spain and the Netherlands.

CTV adoption and the appetite for video-on-demand

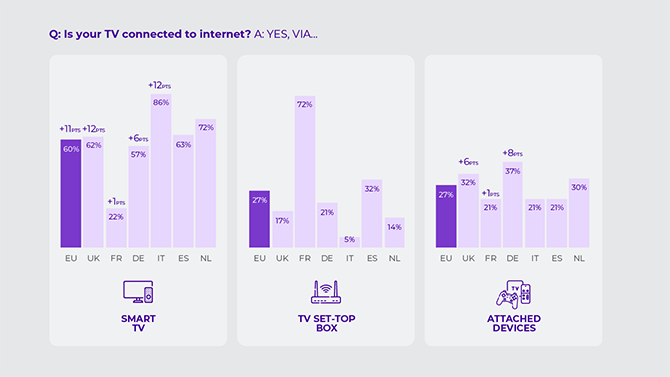

Across the EU6 countries, the majority (60%) of survey participants who have connected their TV to the internet have done so through their Smart TV. This trend is most apparent in Italy, where 86% of CTV viewers surveyed use a connected Smart TV. Meanwhile in Germany, audiences split their connected viewing methods between smart TVs (57%) and external devices (37%), demonstrating how connection varies across regions. In France, however, telco and payTV operators have a strong market presence, which explains why 72% of French respondents primarily connect their TVs through a Set top box (STB).

Respondents across the EU6 countries most value CTV for accessing long-form premium video content. SVOD continues to be the majority of German (55%), French (56%), Spanish (58%), UK (59%), Italian (62%) and Dutch (65%) participants. Interestingly, however, heavy SVOD subscribers appear to be tuning in to more free streaming platforms such as Pluto.TV or Molotov TV.

The ascent of AVOD is one to watch

The adoption of AVOD and free ad-supported streaming platforms (FASTs) among the EU6 respondents stands at 38%, with viewers using multiple platforms to stream free content in return for ads. Over two-thirds (68%) of EU6 participants also say they access free video platforms every week of which half of them do so daily

The survey findings suggest that when CTV audiences adopt ad-supported platforms, they become a frequent viewing habit. In Germany, for instance, more than one-third of respondents watch video content on AVOD platforms daily.

Cost is the most significant driver behind the uptake of these platforms, with 60% of the EU6 viewers surveyed citing free access as its biggest appeal. Additionally, more than a third of participants (36%) believe ad-supported services offer an attractive variety of quality content, which furthers their adoption.

It’s time to build the best ad experience

With various video platforms delivering different ad experiences, the consumer study also explored audience preferences for advertising on CTV. An overwhelming majority (64%) of the EU6 respondents consider the TV-like ad experience to be the most attention-grabbing, and this perspective is consistent across regions. This finding highlights the advantages of premium video platforms when it comes to campaign impact.

Ad personalisation in CTV environments is a core aspect of impactful advertising, with 37% of EU6 participants preferring ads that relate to their personal interests or hobbies. Furthermore, CTV viewers who took part in the survey were receptive to ad personalisation around their lifestyles (30%) and their values (23%).

Having said that, the study highlighted that personal data is a strong concern for connected viewers, as 62% of respondents state they are not willing to share their information in exchange for personalised advertising. In this data-driven advertising ecosystem it is paramount for the different players to ensure they put the users at the centre of everything they do and protect their privacy.

What’s next for CTV?

More than half (53%) of connected viewers who participated in the survey rank the flexibility of watching premium video at any time, as their primary reason for using CTV. Over one-fifth of respondents also appreciate both the quality of CTV’s user experience (23%) and its social aspect (22%), enjoying the opportunity to watch content with family and friends.

It appears, that the adoption of CTV stems from its ability to reflect the traditional linear experience, with the addition of enhanced viewing options. As marketers and media owners continue to embrace CTV, it is essential to maintain both these characteristics: providing trustworthy and high-quality content, while recognising the consumer need for choice and flexibility.

Methodology

*To learn more about consumer preferences and opinions, FreeWheel surveyed over three thousand (3354) connected viewers across the UK (572), France (681), Germany (483), Italy (583), Spain (564) and the Netherlands (471), representative of the local population. The study was conducted between 28 February and 3 March 2022 by Happydemics, the online consumer research specialists.

Download