FreeWheel hosted its annual Premium Programmatic Summit for video publishers, bringing together a group of ~250 industry experts from both FreeWheel and the publisher community. Their goal? Act on opportunities to improve programmatic execution in CTV. Overall, there was acknowledgment that technology is moving rapidly, and the complexity in the ecosystem is compounding by the minute. Through it all, publishers are working on how to holistically match the right supply to the right demand.

There is a big opportunity on the table when it comes to optimizing premium video supply and minimizing revenue lost through inefficient demand connections. It starts with metadata, a staple piece in programmatic content delivery.

A Small Piece of a Big Opportunity

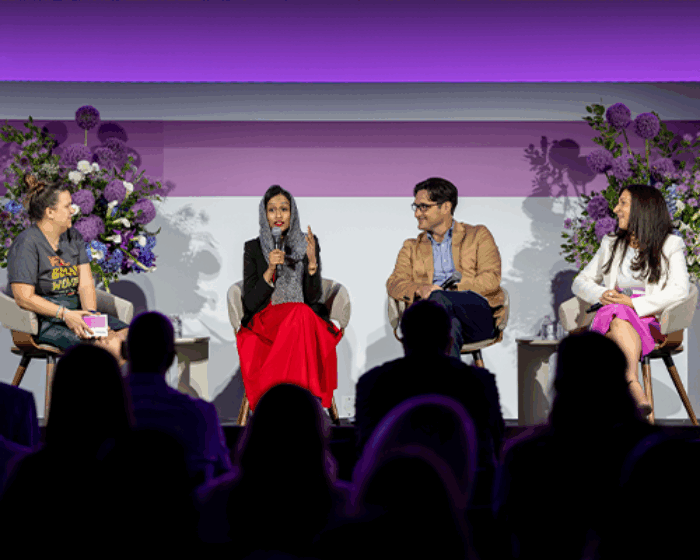

Pictured: Kelly Blasco, Sr. Manager, Advisory Services, FreeWheel and Greg Joseph Sr. Director, DSP Partnerships, FreeWheel

Metadata refers to the signals and information passed in a bid request to demand side platforms (DSPs), and for the programmatic marketplace, it’s what fuels every bid. Accurate and complete metadata is an essential element to continuing the pace of evolution the marketplace is undergoing.

Overall, programmatic is a growing solution and for the supply side, it’s no longer just a side gig—it has become a bona fide component to how video advertising is transacted every day. From 2021 to 2022, FreeWheel recorded a 12% increase in programmatic buying for TV and premium video advertising.1 Much of the increase can be attributed to growth in CTV where spending is projected to grow by 21% in 2023.2

Still, there’s lingering hesitation on the demand side when it comes to programmatic adoption, due largely to transparency and consistency. Buyers want to know what they are bidding on at a basic level, often asking for more information on device type, the specific programs their ads run in, the content genre their campaigns are aligned to, and more.

A simple fix to quell buyers’ concerns is for publishers to prioritize the efficient passing of basic metadata signals like object type and app URL, as well as the additional information DSPs are asking for. Doing so will help piece together a more complete picture of what’s being sold to enable better decision-making for buyers.

A Request for More Education & Specific Information

When agencies met in early 2023 for FreeWheel’s Programmatic Activation Summit, they expressed the need for more education to enable an automated, data-driven future. That was the common thread during the recent summit session aimed at Powering your Programmatic Supply with Better Metadata. More education on what types of actionable information and signals are needed by the DSPs so that publishers can work towards enabling those requests.

Because advertisers and agencies using DSPs are primarily focused on understanding their users/audiences, it’s important that publishers provide more robust information. Publishers should consider thinking about metadata as:

1. Audience insights: the “who”

2. Inventory insights: the “what”

Passing information tied to these two metadata categories will unveil more specifics about the inventory being bid against and help solve buy-side requests.

Calling out Buy- & Sell-Side Challenges

The reality is that today, 30% of the metadata passed in the FreeWheel marketplace by publishers is either missing or incomplete.3

When publishers provide incomplete metadata to the programmatic video bid stream, it’s more difficult for DSPs to bid on a publisher’s full supply. Buyers do not feel they have full insight into what they are bidding on. Program genre information is high on the list of buy-side requests, yet it’s rarely provided by publishers as part of their content’s metadata. During one of the event’s sessions, a DSP representative noted that genre metadata was included in just 6% of the inventory being passed, yet 46% of their bids overall are happening on the supply complete with genre information.

There is a clear case for including more metadata in publisher inventory, but it is also important for the buy-side to consider when targeting has become too precise. When advertisers want to leverage parameters like geography, niche audience segments, and impose strict frequency caps, the available inventory (and overall opportunity to reach audiences at scale) lessens. More is not always more.

It’s important for buy-side representatives to consider not only the requisite level of targeting needed for a given campaign, but also how to put the information provided by the publisher to work. For publishers though, the time is now to determine which programmatic signals provide the most impact, knowing some signals are harder to pass than others. With greater transparency comes additional value.

What the Future Holds

Before more sophisticated metadata is passed, and additional buy-side asks are met, the basic level of information needs to be accounted for. FreeWheel has developed A Guide to Programmatic Metadata, inclusive of checklists designed to help publishers alleviate metadata-specific challenges. The guide echoes IAB guidelines and recommends solutions that U.S.-based programmers can use to enable biddable activation and more supply.

Metadata was somewhat of a black hole and with a lack of standardization there was historically not much either side could do with this information. We now know that metadata is the missing piece to enable matching of the right supply to the right demand. A marketplace rich with robust information and signals will provide value on the buy and sell sides and lead to a much healthier ecosystem.

For publishers wanting to conduct a “metadata audit,” contact your FreeWheel representative or click here to get started.

Sources:

- FAST Channels Redefine Distribution. FreeWheel Video Marketplace Report 1H 2022.

- US CTV Ad Spending 2021-2027. eMarketer March 2023

- FreeWheel’s Monetization and Revenue Management (MRM) platform proprietary information