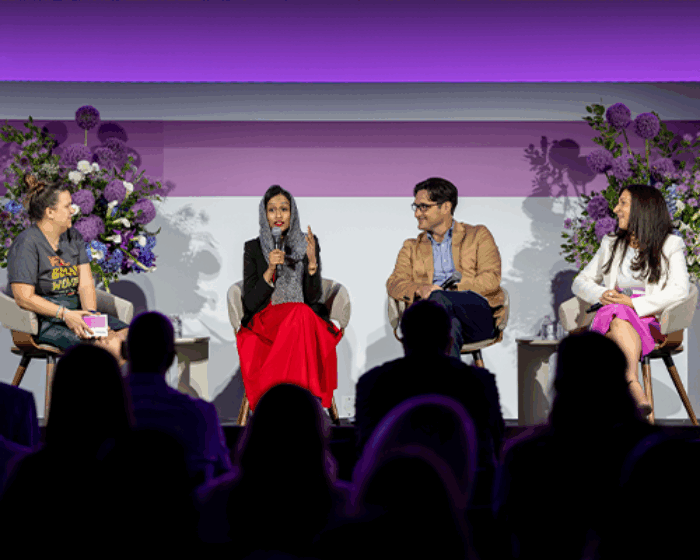

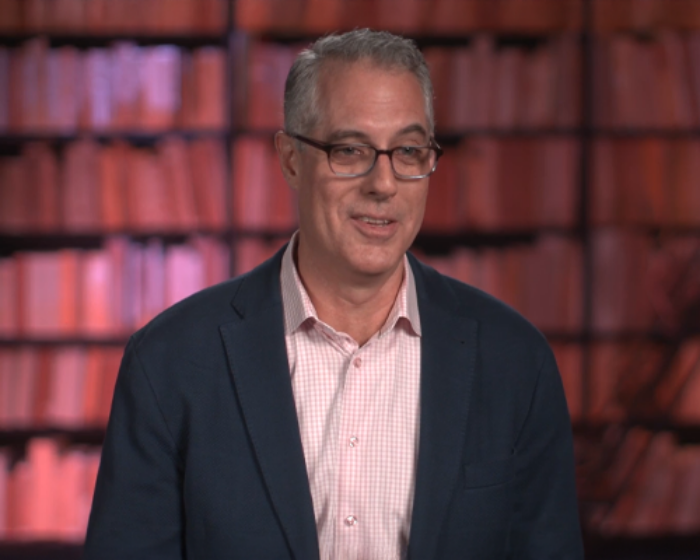

Media industry leaders gathered at FreeWheel’s 2023 Programmatic Activation Summit to address the current state of programmatic buying for premium video. Opening speaker and Media Universe Cartographer, Evan Shapiro gave a rousing opening overview of today’s media landscape, its coalescing and evolving across multiple endpoints, generational demographic behaviors, and why it’s important to have a holistic view of the premium content space.

Key Takeaway

Thinking like consumers is vital. There is a “yes, and…” component to what consumers expect from their media. Consumers mix and match to what works best for them.

Programmatic was the real driver of this event, with two separate panel discussions from different perspectives on the industry. The first was a discussion with programmers from Paramount, Warner Bros. Discovery, and NBCUniversal. The second panel introduced agency perspectives with programmatic leaders from Publicis Media, Matterkind, and Havas Media.

Content Remains Regal

In addition to the meteoric rise of FAST channels (50% of all OTT ad views, according to the latest FreeWheel Video Marketplace Report), the programming panelists featured have had ongoing success with their paid ad-supported television as well. Panel moderator, Alex Strickland of FreeWheel, estimated that the three companies represented will represent $30 billion in ad spend this year. From March Madness coverage on Warner Bros. Discovery and Paramount, delivering 67 games on 18 platforms, accounting for one billion live video hits to date in the tournament, to nearly 80 million monthly active users on Peacock, premium content is at an all-time high.

Brendan Garrone of NBCUniversal explains why consolidating supply within an addressable footprint can bring targeted scale to buyers. “Traditionally, you’d go to companies like the ones represented here for your direct business for scale and then you’d use programmatic for your reach with less premium, longer tail players,” he explained. “The focus here is to deliver both premium content and reach together.”

Key Takeaway

Consumers are assembling – and constantly reassembling – their streaming bundles to be on the biggest and best screen to watch premium content. Sports, live news, and premium original content will always be the gravitational force for viewers. While their content choices may vary, TV is the platform that they want it delivered on.

TV-ifying Programmatic

Brands have become accustomed to advanced metrics of digital advertising, ones that TV is still adjusting to and developing.

Garrone points out that “Programmatic wasn’t built for TV, it was built for a way to buy display ads on the open exchange.” Getting clients onboard a move from the established system of direct I/O deals to a higher-priced model of biddable and programmatic requires strong relationships and trust. But once advertisers come on board and jump into programmatic, “Most of them see the value in the advanced metrics and KPI,” according to Larene Mantel of Matterkind.

Key Takeaway

Premium video and the complexities of TV measurement may not have been where programmatic started, but it’s certainly where it’s going. Programmatic is shedding the baggage of its online past and moving into live, premium televised content that delivers immediate scale, not audiences that accrue over time.

Why Programmatic?

There were many key points that were made throughout the discussions, but the first consideration is an existential one–why programmatic?

According to the agency panel, the question really should be inverted, “Why not programmatic?” The panel discussed that unless there’s a specific type of ad execution that requires direct I/O, there may not be a compelling reason to [transact] that way. Fundamentally, the panel believes it’s about the strong relationship clients and agencies need to have. If clients are confident in their desired outcomes, the agencies can execute the media plans to deliver those results.

Education on the benefits of programmatic is critical for everyone involved, from buyers to ad tech to publishers. It’s a data-driven future that needs to let go of the I/Os, CPMs, and other relics of the television industry’s past.

Key Takeaway

Programmatic is no longer additive to a marketing campaign, it is a fundamental way for advertisers to drive and measure outcomes.

The Growing Role of Metrics

Despite the automation of programmatic, there’s still a lot that’s handled by traditional media planning teams. They’re still determining how consumers are spending time with media, conducting content analysis, working with first-party data and how it might best be utilized in the biddable space.

Moving from CPM to additional metrics such as incremental reach or cost per unique household, “that’s where we start to win, where advertisers start to see the benefit and that they’re getting what they paid for,” added Mantel.

Advanced metrics like biometric tracking can give a better indication of engagement, according to Tom Grant of Havas Media. “We’re seeing what kind of engagement we’re really getting, starting to see how things that are more expensive and more premium with a lower ad load are generating more attention.”

There’s still room for improvement in programmatic metrics, for instance ad minutes per hour is not represented in programmatic right now. “On some premium services, there might be four minutes of ads per hour, but on some FAST channels there may be over 10 minutes of ads per hour. There’s a big difference in ad recall for that hour,” explains Jon Mansell of FreeWheel.

But those metrics that are in play for programmatic right now —and they are legion — should be enough of a carrot to entice advertisers who are still on the fence about making the strategic leap to the programmatic marketplace.

It’s hard to argue with the data that’s available through programmatic: audience targeting; frequency capping and mitigating overexposure standardized, proper signaling for ad verification; deduplication; and real-time optimization are the most common. It all heralds better efficiency, an improved path to premium inventory, and maximized ad dollars.

All of these factors can contribute to a winning formula for brands. But more importantly for the future, a better user experience for their customers.

Key Takeaway

It’s not about cost. It’s about ROI.