For the past 10 years, FreeWheel has analyzed the US and European premium video marketplaces, drawing on one of the world’s largest datasets on the usage and monetization of professional, rights-managed digital video content to provide trends, insights and context to illustrate the industry’s evolution. For this special report, we are focusing on France, analyzing digital video distribution, monetization and audience behavior across the market’s six major broadcasters.

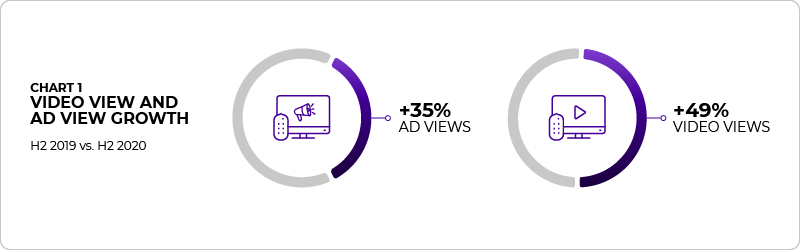

Digital video views (+49%) and ad views (+35%) continue their double-digit growth in the French market. Throughout the pandemic, French viewers relied on all types of screens to stay informed, connected and entertained.

Understanding CTV adoption in France

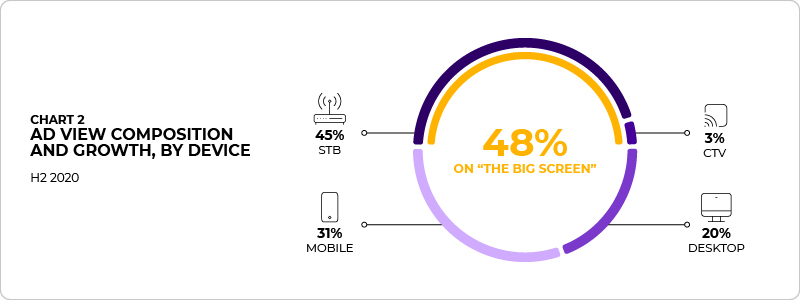

In 2020, 45% of premium video views took place via FAI/Operator’s Set Top Boxes connected through the IPTV/Hbbtv protocols. Historically in France, consumers have been accessing content through the Operator’s STB interface, which has limited the growth of Connected TV (CTV) which currently represents only 3% of total ad views among broadcasters’ digital video inventory. Often a user will remain in the STB environment to access the broadcaster’s replay programs and only come out of that environment to access specific streaming services such as Netflix, MyCanal or Molotov’s Mango on the CTV interface. That said, if premium video consumption on desktop is decreasing, mobile devices continue to grow, representing a third (31%) of all ad views.

Note: this data only includes broadcaster inventory in France. It does not include digital premium player video inventory.

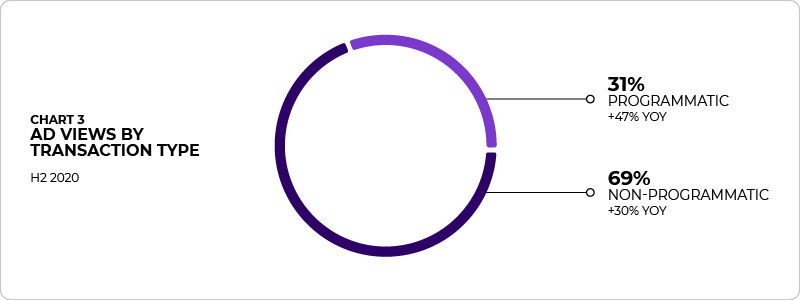

Programmatic adoption increases in France

When it comes to ad delivery, programmatic is gaining traction across major European markets, but particularly in France, where ad views delivered via programmatic pipes increased 47% YOY, accounting for 31% of total ad views, whereas in the US, programmatic accounts for 24%. This noticeable increase (47% YoY) in programmatic delivery is due to programmers deploying unified decisioning that helped better manage yield between their direct sold and programmatic businesses and the launch of programmatic hard guarantee which has allowed broadcasters to secure more spend commitments from the buy-side.

Content trends: live viewing on the rise

While French viewers are watching more live premium content than in the past, live inventory still pales in comparison to other ad inventory types. Live represents 5% of total ad views, versus 95% for on-demand; but live saw a staggering 72% growth rate YOY. Long-form on-demand ad views increased less relative to Live content but still rose by 10% during the later part of the year during the pandemic.

Laying the groundwork for Addressable’s growth

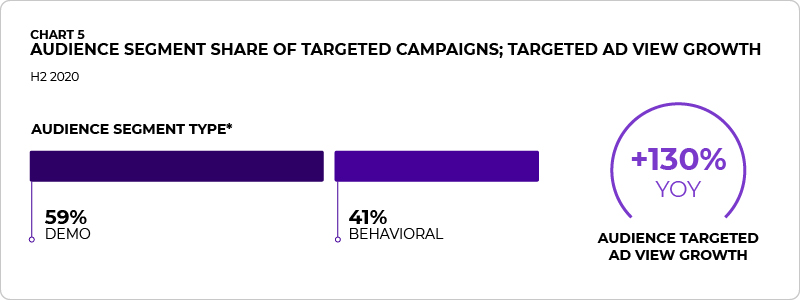

In the French market, broad demographic ad buys continued to dominate (59%). The increase of digital endpoints and time spent consuming content, accelerated by the pandemic, contributed to a small uptick in audience targeting in 2020. Behavioral and demographic targeting, which currently stands at 41%, is poised for dramatic growth in the coming 1-3 years, in part because France recently passed a law authorizing programmers to adopt linear addressable.

In anticipation, programmers have been working with operators to run their first linear addressable test campaigns on STB via IPTV/Hbbtv protocols. For example, France TV worked in partnerships with Orange and Bouygues’ footprints to enable 2 million households with linear addressable. France TV was one of the first to launch linear addressable campaigns with a select number of advertisers in November 2020. Additionally, in an effort to define industry standards, a number of organizations released resources aimed at educating the industry about addressable TV best practices for example FreeWheel’s “Definitive Guide to Unified Video” report. On the measurement front, many measurement companies are rethinking their measurement approach so it can link linear TV, addressable TV and digital campaign reporting to enable cross-media measurement.

*”Demo” audience segment types are those that target based on age and gender, “Behavioral” audience segment types are those that target more advanced segments such as auto intenders, sports enthusiasts, etc.

While France is entering the linear addressable space later than some markets in Europe due to regulatory holdups, all players have been laying the groundwork to support accelerated growth in this space. From a programmatic standpoint, France is one of Europe’s leading players with premium programmatic inventory transacted at scale. Coupling the market’s programmatic expertise with the promise of addressable’s audience targeting capabilities should mean further growth for premium video and exciting new opportunities to reach audiences for advertisers.